Sonas Capital Partners

why multifamily

Why Smart Investors Choose Apartments Over Stocks & Bonds

Looking for high returns without the high risk? Multifamily apartment investments may be your answer.

Unlike volatile stocks or low-yield bonds, apartments offer a unique blend of equity growth and consistent monthly cash flow. These investments are backed by tangible assets and driven by constant demand for housing—making them a resilient choice in any market cycle.

Steady income

Potential for strong appreciation

Lower volatility than traditional markets

Multifamily investments outperform other real estate classes

Apartments consistently lead the pack when it comes to real estate performance. Among all property types, multifamily investments have proven to deliver the strongest returns. Thanks to steady rental demand and efficient management structures, multifamily properties offer both substantial cash flow and long-term equity growth. This combination makes them one of the most resilient and profitable real estate asset classes—outperforming industrial, office, and retail sectors over time.

| 7-Year Holding Period Return (1987 - 2016) | |||

|---|---|---|---|

| Property Type | Mean | S.D. | Sharpe Ratio |

| All | 7.87% | 3.56% | 0.62 |

| Apartment | 9.05% | 2.81% | 1.21 |

| Industrial | 8.27% | 3.75% | 0.70 |

| Office | 6.99% | 4.76% | 0.28 |

| Retail | 8.68% | 3.54% | 0.85 |

Take Advantage of Enhanced Tax Benefits

Our team exclusively acquires stabilized apartment buildings—with occupancy rates above 80%—that are already generating positive cash flow. This strategic approach allows our investors to earn healthy, consistent returns while often showing a paper loss at year-end due to powerful tax incentives.

Leverage 3 Key Types of Depreciation to Reduce Your Tax Burden:

Standard or Straight-line Depreciation

Accelerated Depreciation

Bonus Depreciation

Cost segregation studies are performed on all of our assets. Tax benefits also pass through to our investors via annual year-end reporting on K-1s issued for the preceding year.

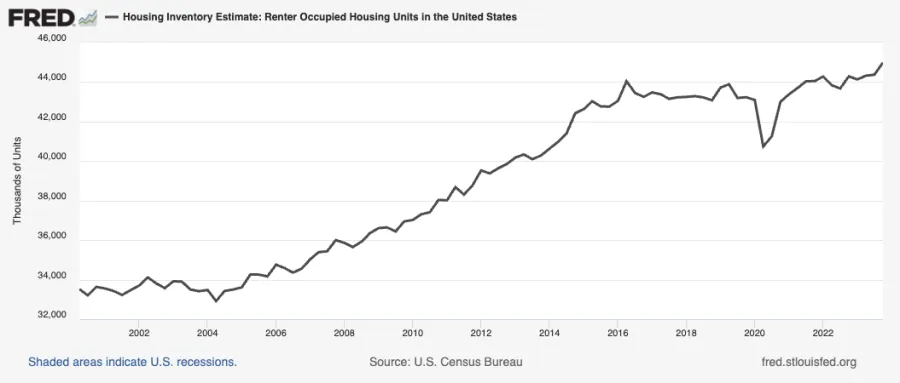

Apartment Demand Is Surging—and It’s Not Slowing Down

Since peaking in the mid-2000s, homeownership rates have steadily declined. Today, a growing number of millennials and aging baby boomers are prioritizing flexibility and mobility over ownership. This shift in lifestyle preferences is fueling unprecedented demand for apartment living—making multifamily investments more attractive than ever.

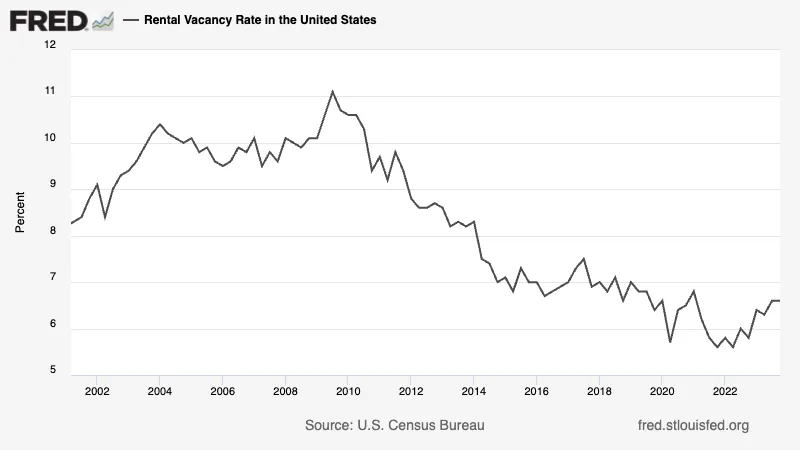

Low Vacancy Rates Driven by High Demand

As population growth fuels housing demand, apartments remain in high demand—keeping vacancy rates at historic lows. This sustained need for multifamily living results in consistent occupancy, stronger cash flow, and accelerated equity growth. For investors, that means higher and more stable returns over time.

BOOK AN APPOINTMENT

Ready to take the next step?

FOLLOW US

COMPANY

CUSTOMER CARE

© Copyright 2026. Sonas Capital Partners.

All Rights Reserved.